Today we announced our financial results for the first half of FY24.

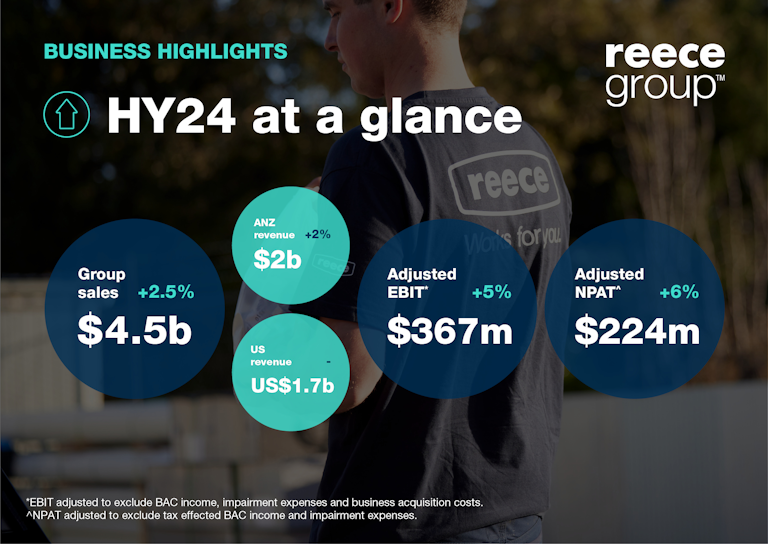

Sales revenue is up 2.5% to $4.5bn (HY23: $4.4b) and Adjusted EBIT is up 5% to $367m (HY23: $348m).

Peter Wilson, Group CEO, said: “We delivered a very solid HY24 result, underpinned by our resilient business model and strong ongoing execution by the team. I am really proud of how the team has focused on strong execution of the fundamentals to continue delivering our customer promise, which is the driver of our success as a business.”

In Australia and New Zealand (ANZ), revenue increased by 2% to $2bn (HY23: $1.9bn). This result was driven by moderating inflation and supported by an ongoing backlog of activity.

In the US, revenue was flat at US$ 1.7bn (HY23: US$1.7bn). The result was driven by a subdued trading environment and modest deflation for the half.

Across both regions, we continued our focus on operational excellence. Training and support were rolled out to refresh our network’s expertise in delivering our customer promise, and we continued investing in our branch network through relocations, refurbishments, and new branch openings. We have also continued rolling out the Reece brand in the US, with 62 branches now trading as Reece across six states. At the end of the period, we had 655 branches in ANZ and 240 branches in the US.

Reflecting on the outlook for the remainder of the financial year, Peter Wilson said: “As we look ahead to the second half, we expect subdued demand across our business, with a softening in the ANZ environment. We take a long-term view and will continue to invest to build a stronger business and deliver on our 2030 vision of being our trade’s most valuable partner.”

For more details on the HY24 results, head to our investor centre.