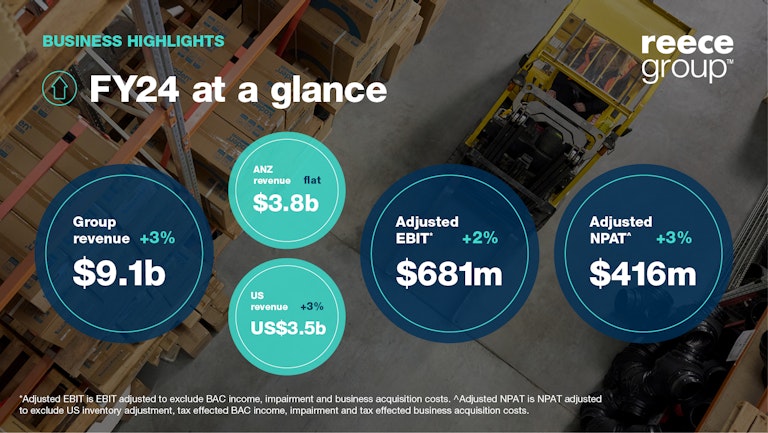

Despite a challenging trading environment, Reece Group (ASX: REH) delivered a solid result in FY24, with Group sales revenue up 3% on the prior year to AU$9.1 billion. Adjusted earnings before interest and tax were up 2% to AU$681 million and adjusted net profit after tax was up by 3% to AU$416 million.

Group CEO Peter Wilson said, "Reece delivered a solid result in a challenging environment in FY24, supported by the teams’ ongoing disciplined execution.”

“As we faced into the softer trading environment, we intentionally set out to refocus the team on the fundamentals of trade distribution, in core skill programs such as selling and trading. These are the foundations of the Reece model underpinning the success of our business”

ANZ region

In Australia and New Zealand, sales are flat at AU$3.8 billion, impacted by softer housing markets.

During the year we continued to excel in delivering our customer promise and focus on executing the fundamentals brilliantly. We also continued to invest in our branch network, delivering 15 refurbishments and adding six new branches to the network. Reece Group now operates 661 branches across the ANZ region.

In April, we opened our new distribution centre in New Zealand, which enhances our capacity and provides us with further flexibility to scale. This has allowed us to streamline our supply chain and enhance our offering for our Aotearoa customers.

As we strive to be our trade’s most valuable partner, we continue investing in products and innovation to give our customers an edge in the market. Over the year we launched several new products in ANZ, including Flowtite and Thermann Smart Electric.

US region

In the US, revenue was up by 3% in US dollars to $3.5bn, with the overall trading environment remaining challenging.

Operationally, we focused on supporting the growth of our team and embedding the Reece culture across our US network. We have continued to upskill our team through our customised learning and development programs, including the launch of a new leadership development program for Branch Managers and the development of ‘career roadmap plans’ for critical roles across the organisation.

We have continued the growth of our network footprint and uplifting standards, welcoming 12 net new branches and undertaking 4 refurbishments. Around 80 per cent of our Reece rebrand project is now complete – an exciting milestone for our US business.

Outlook

Reflecting on the outlook for the business, Wilson said, “While next year is likely to remain challenging, we will continue to focus on the long-term. We invest through the cycle to ensure we are well placed to support customers as the market recovers.”